Business Insurance in and around Branson

One of Branson’s top choices for small business insurance.

No funny business here

Business Insurance At A Great Value!

When you're a business owner, there's so much to focus on. You're in good company. State Farm agent Bill Johnson is a business owner, too. Let Bill Johnson help you make sure that your business is properly protected. You won't regret it!

One of Branson’s top choices for small business insurance.

No funny business here

Protect Your Future With State Farm

For your small business, whether it's an ice cream shop, a farm supply store, a shoe repair shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, computers, and equipment breakdown.

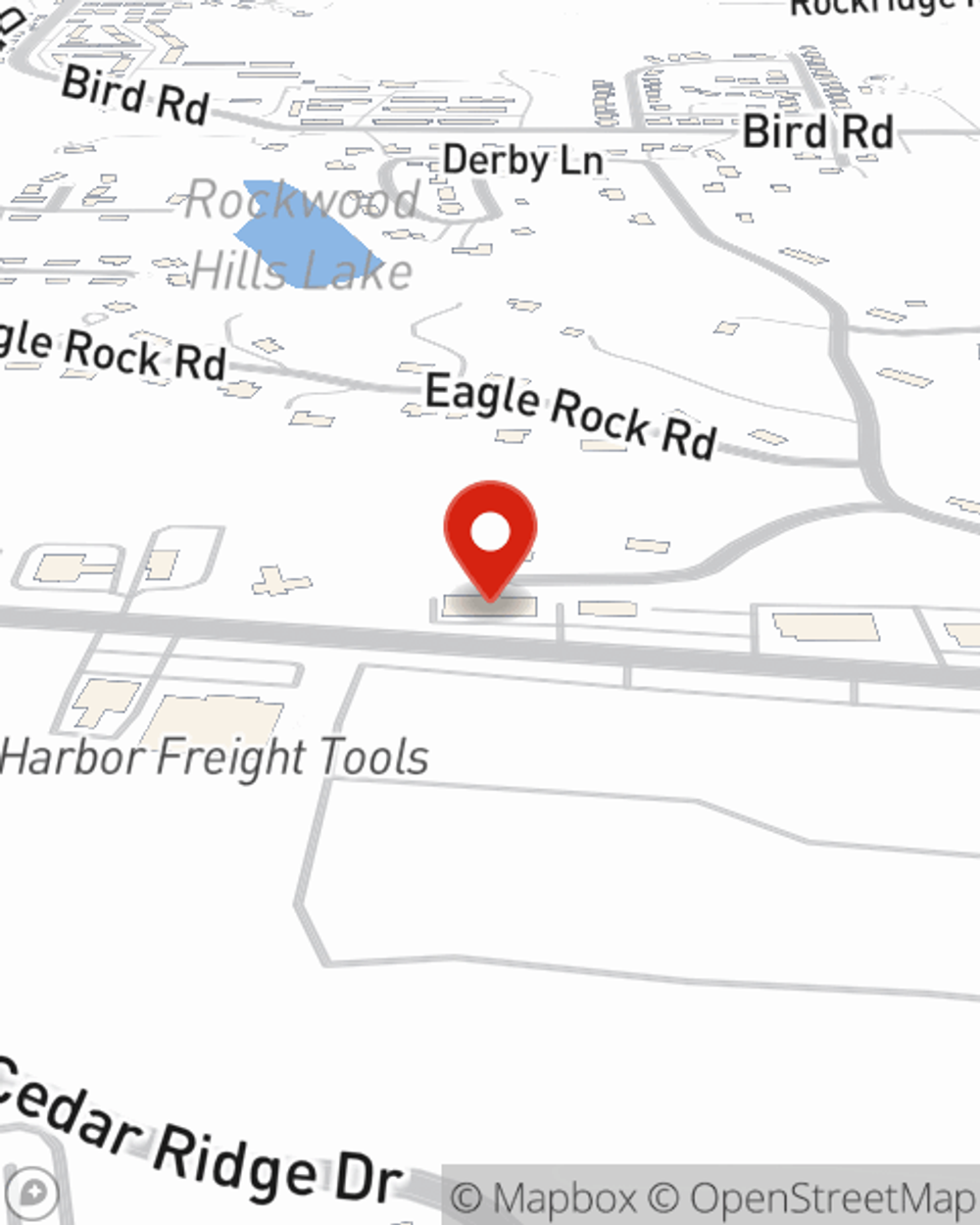

At State Farm agent Bill Johnson's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Bill Johnson

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.